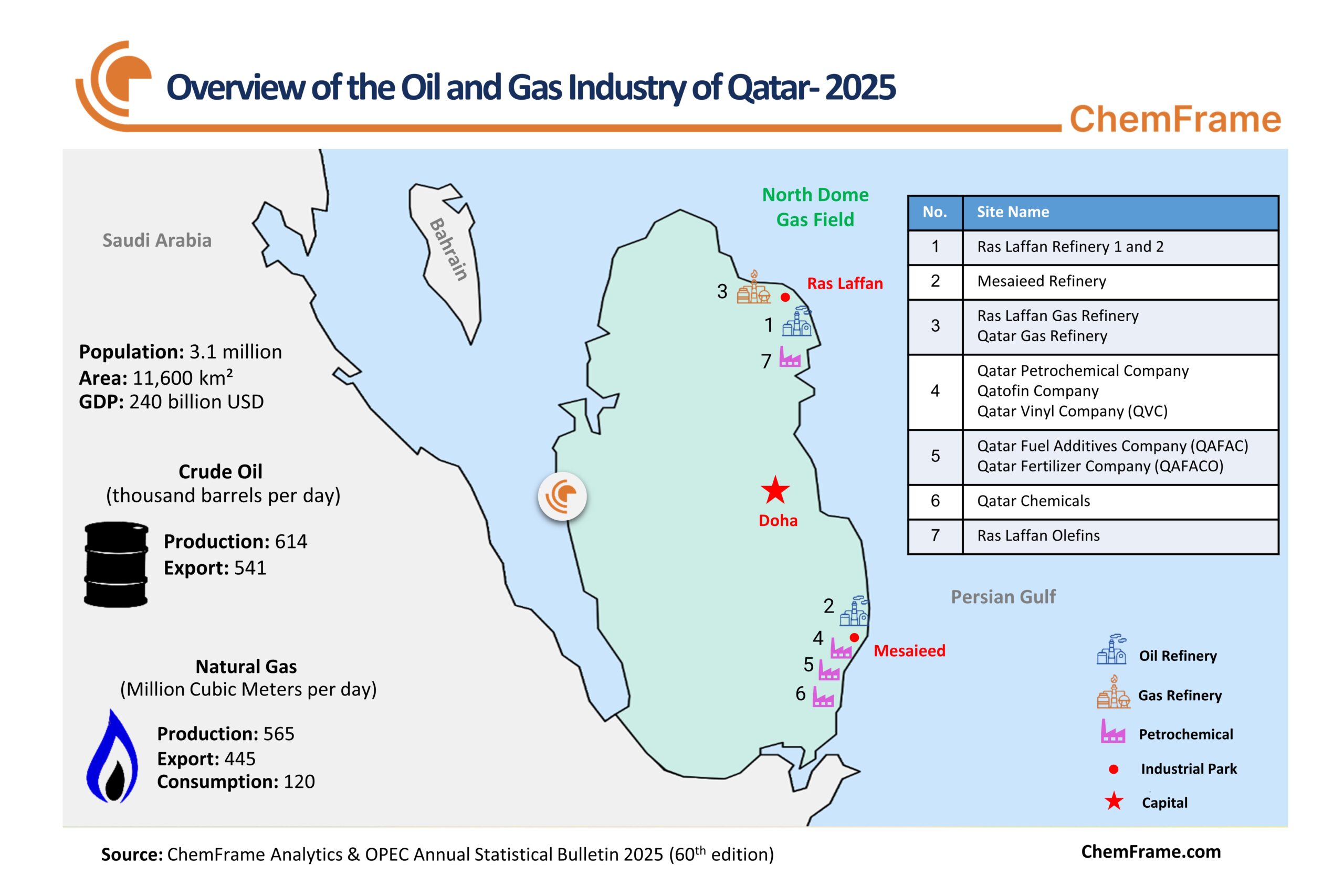

Introduction: Geography and Strategic Energy Role of Qatar

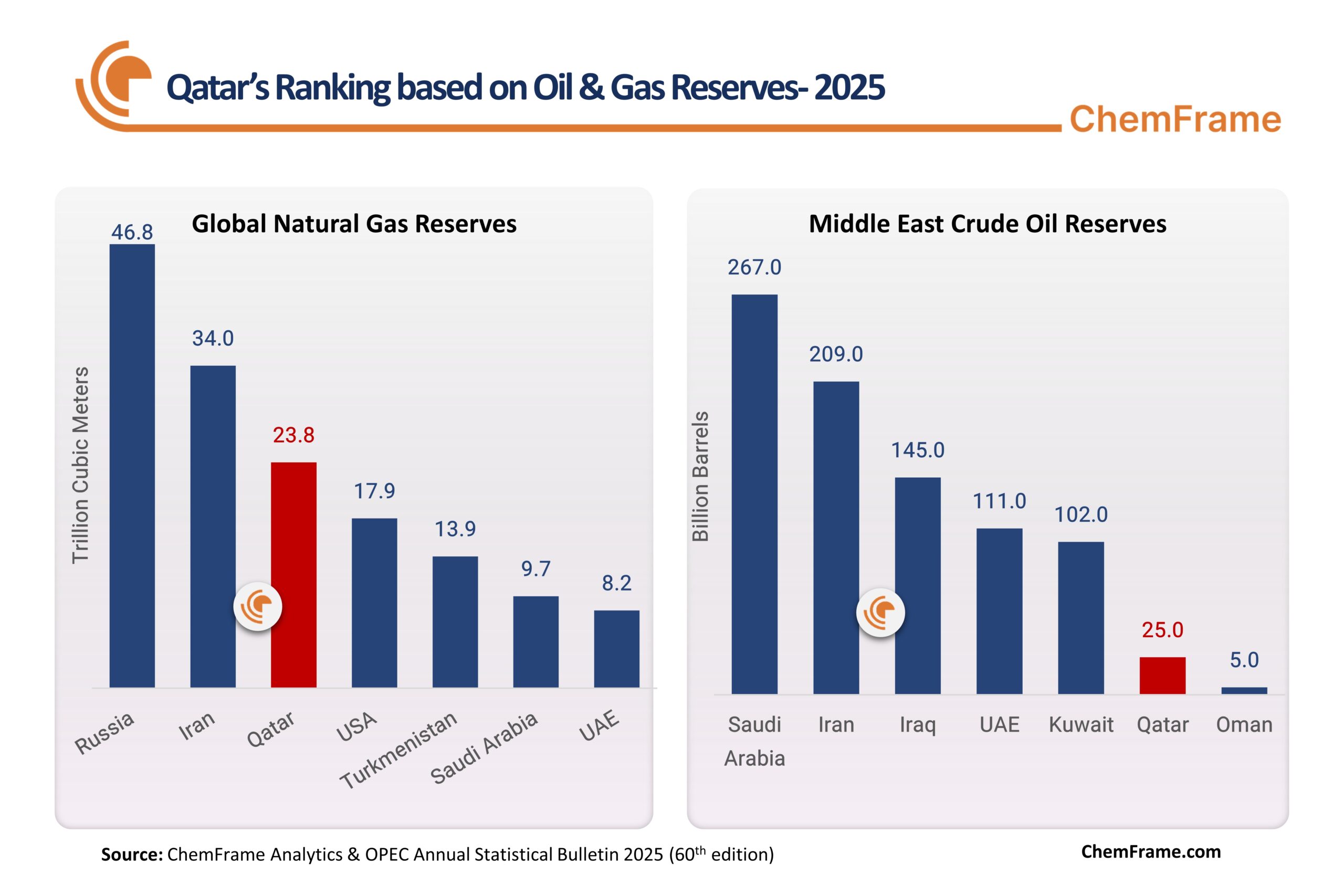

The Qatar Peninsula, with a population of 3.1 million and an area of 11,600 square kilometers, holds reserves of 25 billion barrels of crude oil and 24 trillion cubic meters of natural gas; therefore, it occupies a significant position in the Middle Eastern and global oil and gas markets. Oil and natural gas form the backbone of Qatar’s economy, accounting for more than 70% of total government revenue, over 60% of the country’s GDP, and nearly 85% of its export earnings.

Global Export Leadership in Oil and LNG

As a major global exporter, Qatar ranks 22nd in crude oil exports and 5th in natural gas exports. The country produces an average of 614 thousand barrels of crude oil per day and, in 2024, produced about 206 billion cubic meters of natural gas (equivalent to 565 million cubic meters per day). Qatar has made substantial investments in the production and export of Liquefied Natural Gas (LNG) and is the second-largest LNG exporter after the United States. In 2023, Qatar exported around 80 million tons of LNG and plans to increase production to 126 million tons per year by 2027.

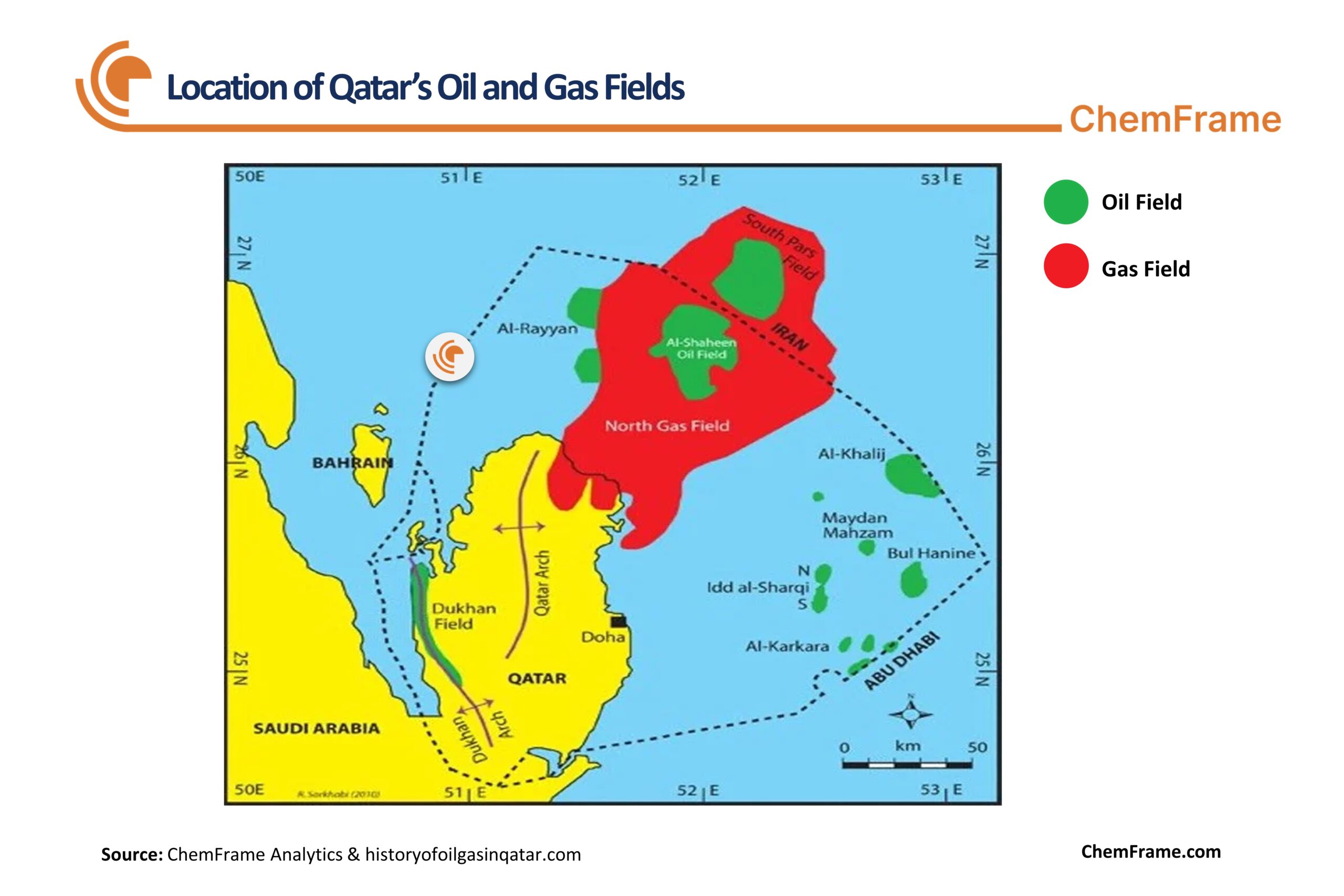

Qatar’s Oil & Gas Fields and Industrial Hubs

There are 12 oil fields and one gas field in Qatar, known as the North Dome (South Pars). Except for one oil field and a small portion of the North Dome field, all fields are offshore. Most of Qatar’s refineries and petrochemical plants are concentrated in the two cities of Mesaieed and Ras Laffan.

Chemical Industry Structure and Key Players

Nearly all major international oil companies operate in Qatar, each managing part of its oil and gas industry. Qatar Petroleum, also known as QatarEnergy, is the parent company of Qatar’s oil and gas sector, overseeing all oil and gas activities in the country and holding the majority share of its oil, gas, and petrochemical plants. QatarEnergy is a state-owned company, and its oil and gas revenues account for 60% of Qatar’s GDP. Overall, in Qatar’s refining and petrochemical industries, most facilities are state-owned. Approximately 80% of Qatar’s refinery and petrochemical units are owned by the government, while foreign private companies, including ExxonMobil, TotalEnergies, and Shell, hold 20%.

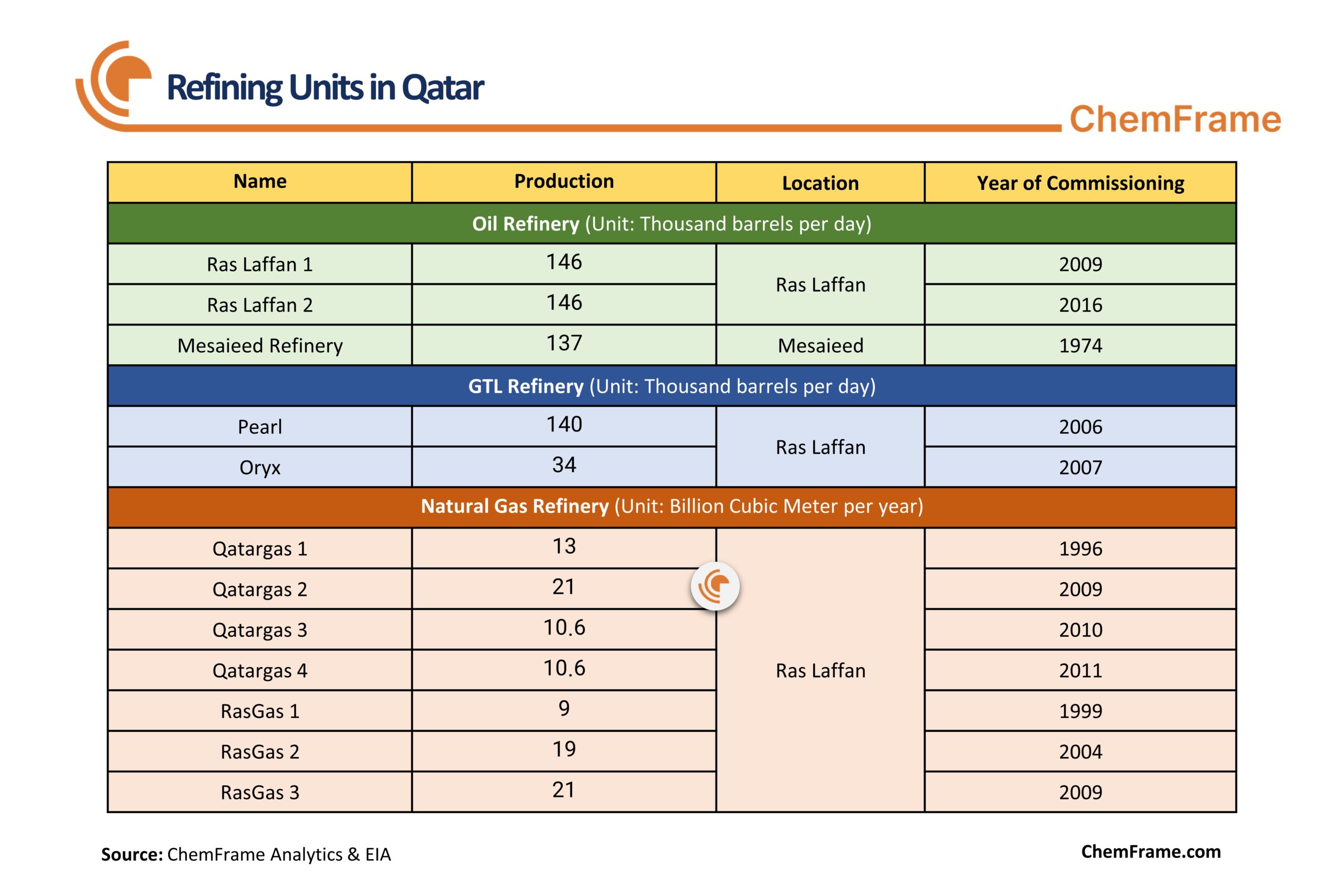

Refining and Gas-to-Liquids (GTL) Capacity

Qatar’s oil refining capacity exceeds domestic demand for petroleum products; therefore, the country exports most of its refinery output. Qatar has three oil and condensate refineries—Laffan 1, Laffan 2, and Mesaieed—with a total capacity of 430,000 barrels per day, as well as seven gas processing trains, including QatarGas 1-4 and RasGas 1-3, with a total annual capacity of 105 billion cubic meters. Qatar also has two Gas-to-Liquids (GTL) plants, named Oryx and Pearl, with a combined capacity of 140,000 barrels per day. In the GTL process, natural gas is converted into liquid products such as naphtha and diesel.

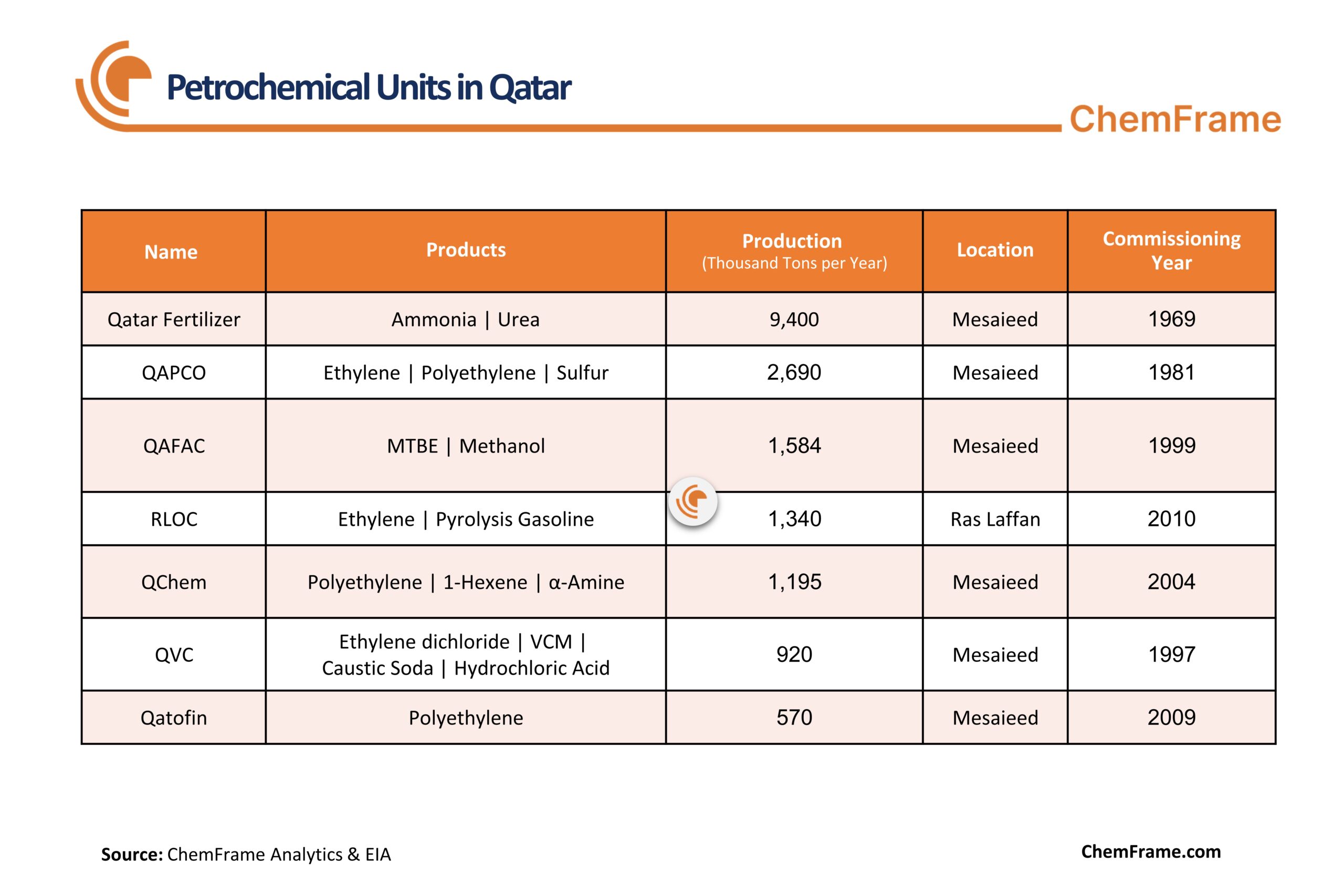

Overview of the Petrochemical Sector

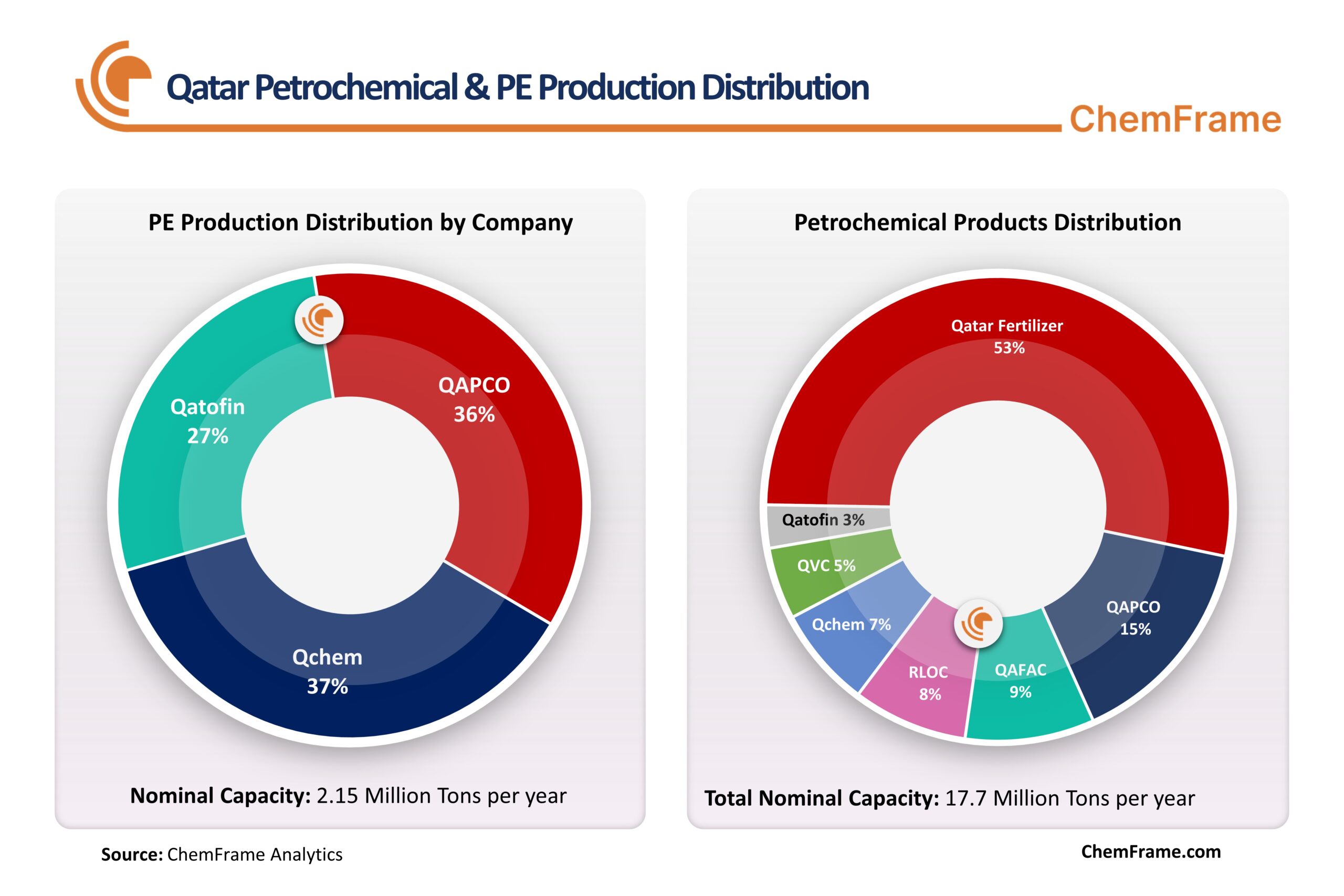

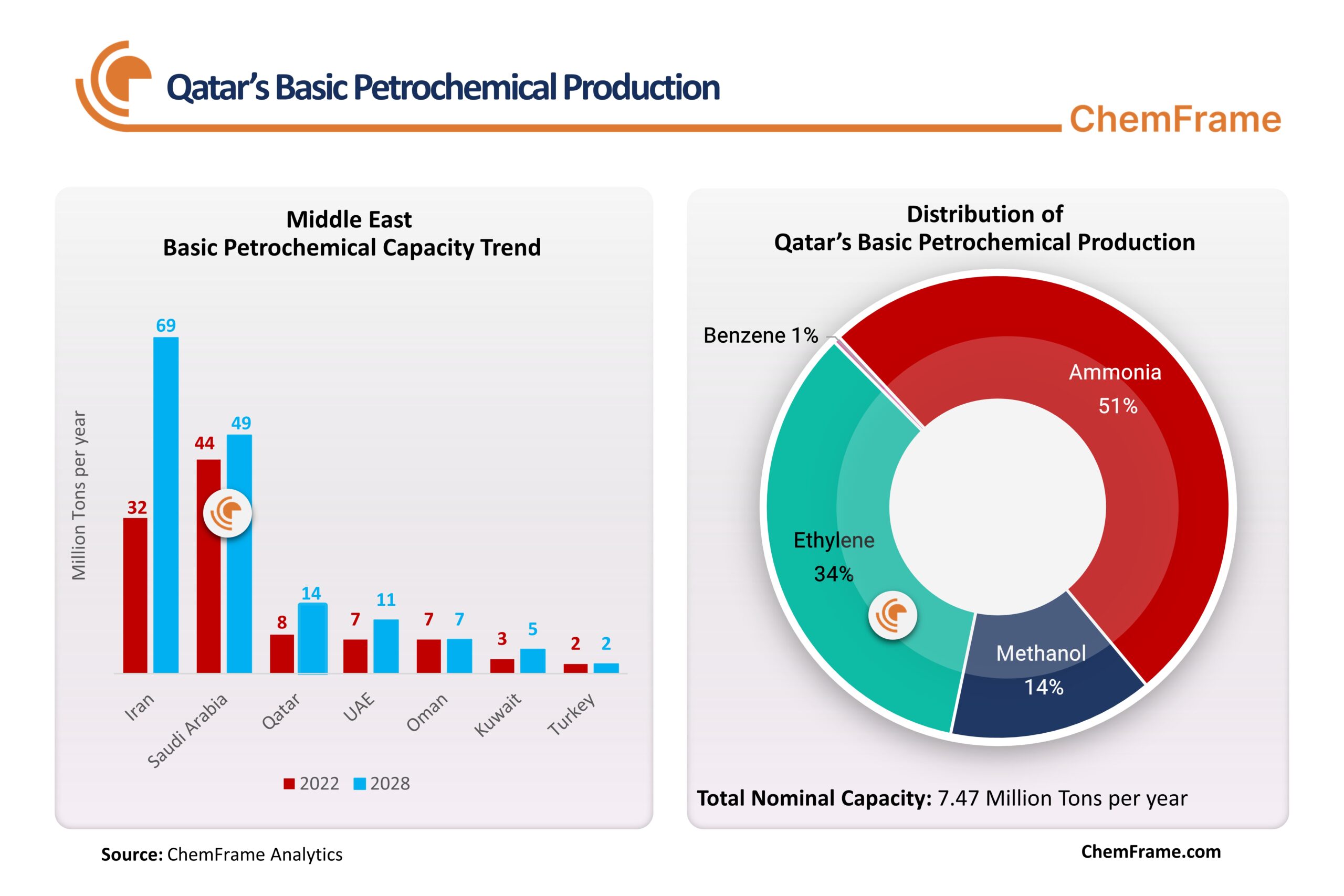

The petrochemical industry is one of Qatar’s most thriving sectors, making the country one of the largest petrochemical exporters in West Asia. Among Arab countries, Qatar ranks second after Saudi Arabia in petrochemical production, with an annual output of 17.7 million tons. Qatar’s main petrochemical products include ethylene, polyethylene, ammonia, and methanol.

Key Petrochemical Producers and Capabilities

Qatar Petrochemical Company (QAPCO) is one of the largest petrochemical producers in West Asia and is recognized as one of the world’s largest producers of Low-Density Polyethylene (LDPE). Its plants are located in Umm Said (Mesaieed), with 80% of shares owned by Industries Qatar and 20% owned by France’s TotalEnergies. The company’s main products include ethylene with an annual capacity of 840,000 tons and LDPE with an annual capacity of 780,000 tons. Qatofin and Qatar Vinyl Company (QVC) are subsidiaries of QAPCO. Qatofin primarily produces Linear Low-Density Polyethylene (LLDPE) for export, with a production capacity of over 570,000 tons per year. QVC has an annual production capacity of 180,000 tons of Ethylene Dichloride (EDC), 335,000 tons of Vinyl Chloride Monomer (VCM), and 370,000 tons of caustic soda.

Qatar Fuel Additives Company (QAFAC) has an annual production capacity of around 500,000 tons of Methyl Tertiary-Butyl Ether (MTBE) and 1 million tons of methanol, located in Mesaieed.

Qatar Chemical Company (QChem) is a petrochemical complex located in the Mesaieed Industrial City, with an annual production capacity of 803,000 tons of polyethylene (HDPE & MDPE), 47,000 tons of 1-hexene, and 345,000 tons of Normal Alpha Olefins (NAO).

Ras Laffan Olefins Company (RLOC) is another major petrochemical company in Qatar, located in Ras Laffan. With an annual capacity of 1.3 million tons, this facility supplies ethylene to Qatofin and Q-Chem, transporting it via a 137-kilometer pipeline to these plants. It also produces 40,000 tons of pyrolysis gasoline annually as a by-product of the ethylene production process.

Qatar Fertilizer Company (QAFCO) is a major producer of ammonia and urea, with an annual production capacity of 3.8 million tons of ammonia and 5.6 million tons of urea.

Ras Laffan Petrochemical Mega-Project

Since 2022, Qatar has been designing and preparing for the construction of the largest petrochemical complex in West Asia, located in the Ras Laffan Industrial City, 80 km north of Doha. Construction of the project began in February 2024. The Ras Laffan Industrial City covers an area of 294 square kilometers and is owned and operated by QatarEnergy. The project involves a USD 6 billion investment, with QatarEnergy holding 70% of the shares and Chevron Phillips Chemical Company holding 30%. This petrochemical complex will house the largest ethane cracker in West Asia, with an annual ethylene production capacity of 2.1 million tons. The project also includes two polyethylene units with a combined output of 1.7 million tons per year of high-density polyethylene (HDPE). Chevron Phillips intends to utilize MarTech loop slurry technology for polyethylene production.

The location of this petrochemical plant near the North Dome field and Qatar’s gas processing facilities supports an efficient natural gas feedstock supply. The Ras Laffan petrochemical complex covers approximately 435 hectares and is expected to be commissioned by late 2026. The Ras Laffan project is the largest petrochemical investment by QatarEnergy and the company’s first direct investment in 12 years. Once operational, the project will double QatarEnergy’s ethylene production capacity and increase its polymer output from 2.6 million tons per year to more than 4 million tons per year. Samsung Engineering will be responsible for key ethylene production facilities, including the cracker furnace, C2 hydrogenation unit, hydrogen purification unit, and three main compressors. CTCI will handle the engineering of utility infrastructure, including steam and condensate collection and boiler feedwater systems. Procurement and construction activities will be jointly carried out by both companies, while Chevron Phillips will manage the Ras Laffan project.

Conclusion

According to ChemFrame, Qatar has demonstrated a highly effective strategy for leveraging its substantial oil and especially natural gas resources. With world-class gas reserves, strong long-term planning, and a strategic geographic location, Qatar has successfully positioned itself as a global hub for natural gas and LNG exports. Its stable business environment and attractive investment climate have also encouraged significant foreign participation in the energy sector.

At ChemFrame, we believe that Qatar’s ongoing expansion programs—particularly the planned 65 bcm/year (178 mcm/day) increase in gas production capacity from the North Field by 2027, coupled with the Ras Laffan petrochemical mega-project—will further elevate the country’s status as the world’s largest LNG exporter and one of the leading producers of petrochemicals.

Qatar exports the majority of its crude oil, while its petrochemical industry is predominantly gas-based. Today, ammonia, urea, ethylene, and methanol make up the core petrochemical product slate, reflecting a relatively narrow value chain. However, Qatar’s strategy is clear: reinforce its position as a dominant LNG exporter and a key player in regional and global energy security.

Moreover, Qatar recently announced new natural gas discoveries in the North Field, which could raise its proven reserves to 56 trillion cubic meters, further strengthening its long-term competitive edge in global gas markets.

At ChemFrame, we see Qatar’s energy and petrochemical trajectory as one defined by scale, integration, and global market leadership, supported by continued investment in upstream, LNG, and value-added petrochemicals.

FAQs

1. Why is Qatar considered a major player in the global oil and gas industry?

Qatar holds significant reserves of crude oil and natural gas and is one of the world’s largest exporters of LNG. Oil and gas account for the majority of Qatar’s GDP, government revenue, and export earnings.

2. What is Qatar’s LNG production capacity and future expansion plan?

Qatar produces around 80 million tons of Liquefied Natural Gas (LNG) annually and plans to increase capacity to 126 million tons per year by 2027, making it the fastest-growing LNG exporter.

3. Which companies dominate Qatar’s oil, gas, and petrochemical sector?

QatarEnergy (formerly Qatar Petroleum) is the main state-owned company controlling most oil, gas, and petrochemical assets. International companies like ExxonMobil, Shell, and TotalEnergies also operate in Qatar through joint ventures.

4. What are the major oil and gas fields in Qatar?

The North Dome gas field (shared with Iran’s South Pars) is Qatar’s largest and most strategic field. The country also operates 12 oil fields, mostly offshore, supplying its refineries and petrochemical plants.

5. Where are Qatar’s main industrial and petrochemical hubs located?

Most refining and petrochemical facilities are concentrated in Ras Laffan Industrial City (gas processing, LNG, petrochemicals) and Mesaieed (refining and downstream chemicals).

6. What is the refining and Gas-to-Liquids (GTL) capacity of Qatar?

Qatar’s three refining units have a combined capacity of approximately 430,000 barrels per day, and its two GTL plants (Pearl and Oryx) produce around 140,000 barrels per day of high-value liquid fuels from natural gas.

7. What are Qatar’s key petrochemical products?

Qatar is a major producer of ethylene, polyethylene, ammonia, and methanol, with an annual petrochemical capacity of 17.7 million tons, making it one of the top producers in the Middle East.

8. Which companies are leading the petrochemical industry in Qatar?

Top producers include QAPCO, Q-Chem, QAFCO, QAFAC, and RLOC, supplying polymers, fertilizers, methanol, MTBE, and other chemicals to global markets.

9. What is the Ras Laffan Petrochemical Mega-Project and why is it important?

The Ras Laffan Petrochemical project is set to be the largest petrochemical complex in West Asia, featuring a 2.08 million-ton ethane cracker that will significantly boost Qatar’s downstream capacity and export competitiveness.

10. What is the future outlook for Qatar’s oil and petrochemical industry?

With expansion in LNG, petrochemicals, and new gas discoveries, Qatar is strengthening its global position and moving toward higher value-added downstream products and cleaner energy solutions.